Pulse Labs is excited to co-author this look at different approaches to unpacking human factors research with Sam Flemming of Convosphere, a global business insights and intelligence agency that applies social listening expertise to create actionable insights for companies across a range of industries and verticals.

A Hearty Stew

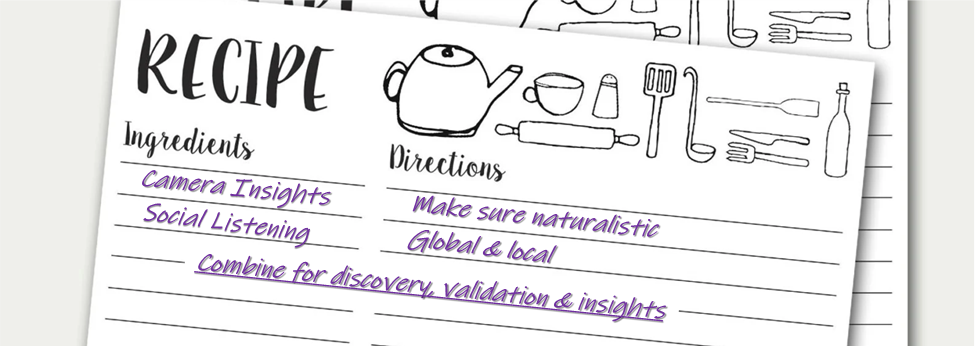

It’s not easy to unpack and understand the consumer / product relationship. It’s like crafting a hearty stew: It takes a lot of quality ingredients blended together just so. Product research is similar: you need many ingredients to tell the complete story. The ingredients include both listening to what people say about a product and watching them engage with the product. That provides robust insights into the physical engagement and the emotional engagement, both of which are crucial to understand in optimizing the customer experience.

One of the best places to listen to consumers is via commentary in which people freely express their views and opinions in unmoderated online environments. That's what Convosphere does. Watching how people engage with products and technology is best done with cameras in naturalistic settings (meaning real people using real technology in natural settings). That's what Pulse Labs does.

At the Core

Here we’re discussing camera capture and social listening as complementary intelligence tools. They’re complements because one relies on volume to reveal tone and prevalence (social) and the other provides granularity and specificity (camera).

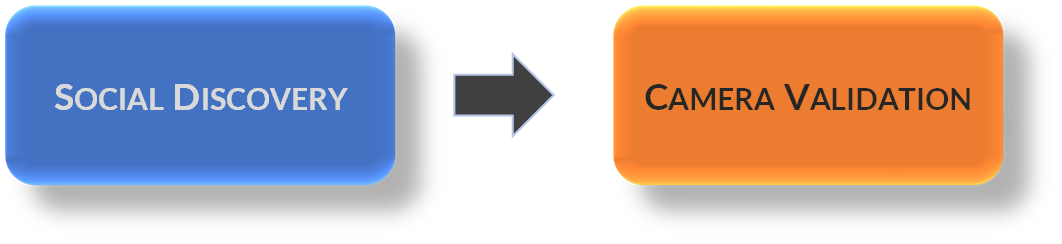

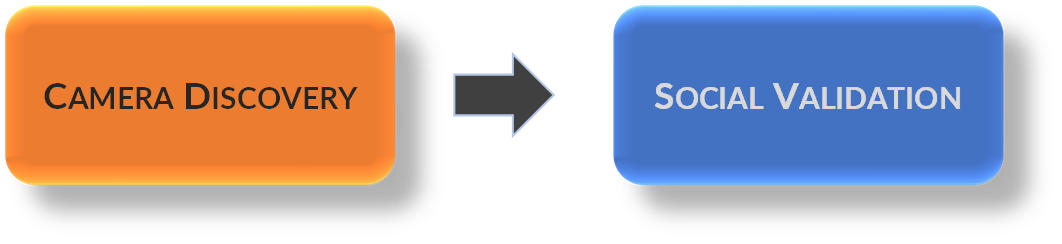

There are two main elements in the product research phase: discovery and validation. So which intelligence tools go with which element? Fortunately, they’re ambidextrous, meaning social can be used for discovery and validation, and camera capture can be used for discovery and validation. Let’s look at two examples:

Social Discovery Begets Camera Validation

Imagine Company A just launched a new product called an Over-Thruster. It seemed to work well with focus groups and engineers reported that it passed all the tests they applied. To validate the in-market experience further, Company A turns to Convosphere’s social listening and brand tracking services. At first, things read positive. But gradually the tone turns more negative, in particular regarding the user interface and certain features. Over time, the negative tone reaches over 60% and analysis of that reveals its driven by the interface. At that point, Company A concludes they have a recurring problem and at a magnitude enough to taint overall consumer feedback.

Company A now turns to naturalistic camera-based insights from Pulse Labs to drill into the interface challenges and get specifics. Based on the social insights, Company A identifies seven core interface usability areas for Pulse to investigate. These will become specific tasks that real owners of the Over-Thruster will complete. For context, they have owners of rival products complete the same tasks. The results show that Tasks 3 and 6 are the issues: owners are struggling to efficiently navigate menu choices related to Task 3 and voice commands are failing for Task 6. Further, these issues are unique to the Over-Thruster (i.e., not seen by rivals).

Company A engineers quickly begin tackling the menu and voice recognition issues, resulting in fast and focused addressing of a problem, using the rivals’ approaches as benchmarks.

Camera Discovery Begets Social Validation

Imagine Company B is evaluating possible updates to the next iteration of its Banzai product. As above, it is using Pulse Labs camera technology in naturalistic environments to capture human factors insights, including benchmarking against rivals. And as with the Over-Thruster, the original Banzai passed all engineering tests in the lab. During one of the 10 tasks owners are asked to complete, it is revealed that satisfaction with a rival product on Tasks 2 and 5 is much higher. The video footage reveals why: on the rival, Tasks 2 and 5 can be completed with one touch of a physical button, while Banzai users have to step through several on-screen menus. Banzai engineers begin considering whether the Banzai 2 should have buttons.

Company B then turns to social listening to weigh in, specifically on the extent to which consumers talk about the buttons on the rival and what they say about them. Insights gleaned by Convosphere’s analyst team reveal that while the button approach is easier than the Banzai menus, consumer see buttons as “old school” and “low tech.”

Using the combination of camera and social, the Banzai engineers opt to change the menu structure on the Banzai 2, making several things available on the home screen (so one touch and no menu layers to go through). This solves the satisfaction issue and avoids any “low tech” brand perceptions. It also saves time and money because the change can be made on the software side rather than the hardware side.

Further Research Recommendations

While the above case studies are informative, they point to vital considerations any time that you conduct social listening and camera capture in tandem as to generate the most comprehensive consumer insights:

🟧 Don’t rely on technology alone: Technology helps gather data quickly and efficiently but fails to consider context, language, emotion and tone. Turning data into actionable insights requires skilled analysts experienced with interpreting those data.

🟧Beware false positives/false negatives. This can happen when relying on one data source without validation. So called vanity metrics, such as Facebook likes, are a notable example. The volume of likes tells you nothing about relevancy or motivation, which requires deep comparisons with other channels and data sources.

🟧 Understand the risks of moderated data-gathering: A moderator adds an unnatural element: in real life you don’t have someone hovering over you or instructing you. That’s why social’s free-form nature and cameras in naturalistic settings have an advantage.

🟧 Consider a product excellence continuum: That would include social and video/audio as well as other elements such surveys, inputs from QA engineers, etc.

Recipe for Product Success

So like a stew made with only one ingredient, product research is incomplete with only one ingredient. It requires a blend of perspectives and inputs to tell the most well-rounded story. But unlike some recipes, product research does not have to be done in a specific order. We encourage all companies interested in creating the best customer/product relation to use a blend, such as Pulse Labs for visuals and Convosphere for social-derived insights. And to use each for multiple purposes, whether discovery or validation. More at www.PulseLabs.ai and www.convosphere.com, or contact sales@pulse labs or info@convosphere.

About Convosphere and Pulse Labs

As a social-first insights agency, Convosphere recognizes that the value of global social listening lies in the impact data-driven decisions can make – and the cultural relevance required to make them actionable. Through hands-on human-led social data analysis across 100+ languages, and with offices around the world, we have unprecedented data access into hard-to-reach markets where we can deliver deep consumer insights that bring our global clients closer to local audiences. We can deliver a little or a lot according to our client’s business needs, from running global social listening projects to providing strategic recommendations across multiple markets, channels or platforms, including owned social platform analytics and additional datasets to put social conversations in context.

Pulse Labs recognizes that managing product excellence is a dynamic and complex task. A multitude of factors impact how people and technology work together, from consumer expectations to technology capabilities. Our Human Factors insights expertise across devices and platforms sets us apart through helping our customers see and hear the results of how all these things work together in real-world settings. That helps the smartest brands unpack how to optimize their customer experiences.